Live business advisors standing by Toll Free

888-893-2993 (M-F, 7AM - 4PM PST)

888-893-2993 (M-F, 7AM - 4PM PST)

Schedule a demonstration of how to automate your prospecting

Schedule Now

How to Be an Expert at Financial Advisor Marketing and Continuously

Attract and Obtain Better Clients

Diversification May Be a Wise Investment Practice, But It’s Lousy for Your Financial Advisor Marketing

From the time you entered into the financial services, you’ve been told that diversification is good. And you can see the evidence with the explosion of mutual fund investing and the public’s desire for and financial professionals’ advice for diversified portfolios. But the same concept in your own business will result in your working more hours, enjoying your work less, being less effective, and never being able to streamline your business. With financial advisor marketing, the “winning formula” is just the opposite of diversification: focus for the best results.

Remember the conglomerates of the 60’s? They’re gone. Just look at what happens when large firms fail to focus–AT&T acquires NCR to get into the computer business and loses a bundle. Kodak acquires Sterling Drug and spins it back to its shareholders six years later. Firms that focus on one business and do it very well have replaced the diversified conglomerates. Look at the corporate leaders of today and how they focus–Microsoft in consumer software, Cisco in Internet connectivity, and Intel in chip manufacturing, Apple in consumer electronics, etc. Each of these firms has a narrow and focused strategy in one industry.

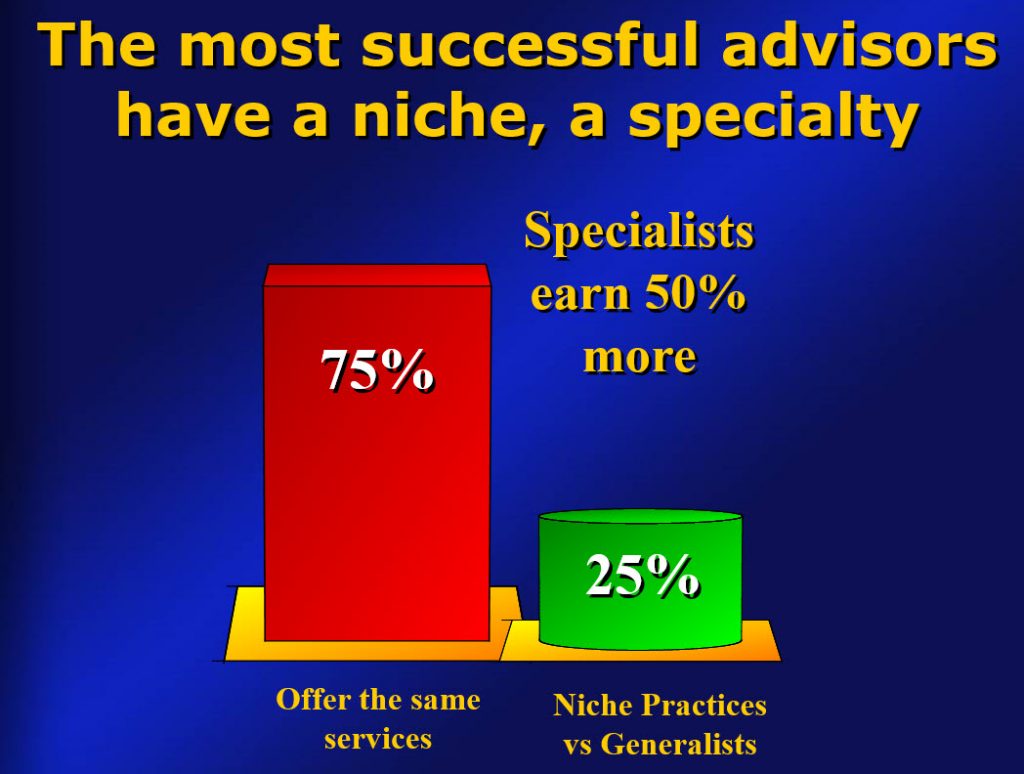

You want to do the same. The winning strategy in financial advisor marketing is to master a niche.

How do these historical examples translate into advice for your business? Pick a market in which to specialize and focus your entire business on that market. Be fanatical about your financial advisor marketing niche.

Here’s my own practice, as an example. I work with people age 60 and over. When my clients ask me to help their 40-year-old children with their finances, I politely refuse and refer them to another planner. Yes, you may think I’m crazy to turn down business, but you’ll see in a minute how much sense this makes.

By specializing in a particular niche, you get to understand how their mentality works — so well that you know what your prospects are thinking before they think it! I work all day with a segment of people who are concerned about protecting their assets. My expertise is built around that concern–the way I design investment portfolios, the approach I take in my appointments, how often I am in contact, and the products and services I offer.

My office is in the suburbs, where my prospects live. I am in a small office building with plenty of parking in the front. My office is on a well-known street and is easy to find. The location was picked to match my prospects’ ease and comforts. The children of my prospects would probably find me more conveniently located downtown and would be more impressed if I were in a high-rise office building with fancy wood on the walls. I cannot find a location that would be optimal for two different audiences. I cannot serve two masters optimally.

If I were to consult with a 40-year-old, he may want me to recommend some good aggressive growth funds for investment. Or he might want to know how to handle his stock options. I have no idea! That’s not my business, and it would be an incredibly inefficient use of my time to learn about products and services outside of my specialty.

If I start working with people outside of my selected niche, I will soon be working more hours to become more expert in other areas, I will need to keep track of more products and develop a presentation for other services. I’d be working more hours, would maybe need more staff, and would probably earn less money. I would be far less efficient. The success in the financial services marketing and practice management is to use the same approach and same building blocks for every client.

Use a Cookie-Cutter Approach In Financial Sercies Marketing

to Achieve a Large Volume in Sales

That does not mean each of my clients gets treated the same. But it does mean that of the portion of their portfolios that contain stocks, they all own the same stocks. If they own fixed-income investments, you will find the same fixed income securities in every portfolio. Mr. Jones may have 60% of his money in equities and Mrs. Smith may have 30% in equities. But the equities they each own are the same because the building blocks I use are the same few for each client. And these building blocks fit well because each client is similar to the other.

But you may be concerned that the niche you select for your focus could decay, and then you’ll be out of business. That’s not so if you do your homework up front:

If you see your niche changing over time, which you will be able to see early because of your specialization, then adjust your message or your approach. You will be more attuned, and you will be able to react early because of your specialization. You will have conquered the key to superior financil advisor marketing.

Here’s an example. Up until 1997, I used a seminar title that focused on increasing a client’s income. That message became less effective as people became accustomed to low rates (as compared to the early 80s) on CDs, bonds and other fixed-income investments. Americans, in general, were much more interested in equity investing. So I shifted the focus of my message to include this new interest but also focused on the preservation of principal aspect desired by my prospects, and my attendance at my seminars popped right back up to previous levels. I was able to see this required shift in my message because I knew my target audience well.

If you want to diversify your clients’ portfolios, that may be fine. But your own practice must be focused, not diversified. To flourish, focus.

Those Who Charge Hourly Enslave Themselves

Often, when we think of a “practice,” we think of the doctor or attorney. In general, the populace holds these professionals in high esteem, as they command high hourly fees for their time. But you and I know that anybody working on hourly fees is a slave to their office. Such a practice is not an esteemed position, but, rather, a form of self-imposed slavery.

Yet for most producers, mimicking the practice of a physician would be a significant improvement. Let me explain.

Many financial advisers treat each individual client as a custom-made, individualized project. Unless you have clients who will pay you a lot (i.e., you earn at least $15,000 annually per client), you will never have a good business with this approach. It’s too time-consuming to provide completely customized service to each client. You can never charge enough to do so. For example, many fee-only financial planners charge $150 per hour. If they bill 2000 hours per year, their gross income tops out at $300,000. Top producing advisors and insurance agents earn 3 times that amount because they are selling the same products and services over and over in a highly efficient manner. Each client is treated in a very similar fashion to the others.

Your business must be set up as a process. If you fail to do this, your financial advisor marketing cannot be effective.

Every new client must get the same services and products. Sure, they may get them in different proportions, but every client who gets the “moderate portfolio” better own the same stocks or you set yourself up spending time on each account, providing personalized service when it’s not necessary. And you’re not being paid enough to do so.

A really good business is a cookie-cutter approach to dealing with clients. That does not mean clients get some impersonal program. It means they get a great program because you have honed the creation of your services and products you offer to the exact needs of the finely focused market you service. If you cannot treat your clients in a similar fashion, then you have not adequately focused on your target market!

Does Intel design a new chip for each customer? No. They do not do projects. Their business is a process, producing millions of the same chips per month.

Should every business be designed as a process? No. Estate planning does not lend itself to a process, as each client may need an individualized program. Just make sure that when you work on a per-project basis like this, you get paid a lot.

Let’s consider some examples to make this clear. Do you think attorneys charge a lot? They have to because it’s difficult to make a process out of the work they do. Each client is a separate consulting project. But notice that doctors set themselves up as a process. Each patient gets 20 minutes:

4 minutes to ask questions

8 minutes to examine the patient

8 minutes to administer a treatment, prescribe a drug, or refer to a specialist

“NEXT PATIENT, NURSE!”

So, the average physician has done much better than the average financial adviser in making their practice into a process rather than a project. However, you can go one step further by turning your practice into a business.

Most people think that attorneys and doctors are high earners. In fact, their earnings are limited by their time. The only way to earn more is

Financial advisors can do much better.

A few financial professionals have successfully converted their practice to a business. Here’s the distinction. When you have a practice, it only generates revenues when you are producing. A business, however, produces revenues whether you’re present or not.

Recently, I spoke to a top-producing stockbroker who told me he was out of the office for two weeks of the previous month, yet he generated gross commissions of $1 million. It was clear he had set up his practice as a business that operated independently of his presence and was designed and staffed by competent people who could continue the business in his absence. Let’s look at how that’s done.

First, you need to design a revenue model that generates revenues unrelated to your time investment. If you spend your day cold calling, that makes you a slave to your phone. Another adviser, who conducts a fee-based business, generates fees whether he is physically present in his office or not. Therefore, your financial advisor marketing must have at its core the acquisition of recurring revenue clients.

Secondly, you need qualified staff to carry on the business in your absence. At a minimum, a licensed service assistant who cannot only service clients but also take trades, write policies and follow up on notes you have left to generate additional business. The process of any financial services business is converting strangers to prospects and then to clients. Any well-trained service assistant can act on this process of converting strangers to prospects (by implementing a direct mail program) or help convert prospects to clients by scheduling appointments for you. Ideally, you will have both a service assistant who handles current client needs and a separate sales assistant who generates new prospects and clients.

Third, you need to design systems and processes for your staff. Many people with practices run each day by the seat of their pants. So when they are not present, very little can get done because systems, processes, and procedures don’t exist to get anything accomplished. Designing such systems and processes is hard mental work. It takes time to refine the systems once you start using them. But the payoff is a business that operates successfully and generates revenues in your absence

Financial professionals pursue a frenzy of financial advisor marketing activities, always looking for the Holy Grail. But many fail to develop any one idea to its ultimate conclusion and point of greatest profitability.

Here’s an example. You hold a seminar. Forty people attend. You get appointments with 12. You do business with six. You decide the results were okay, but not stupendous. So you try the next thing….

STOP!

What about those six who met with you and did not do business? What about the 28 who came to your seminar and did not make an appointment? If you write them off now, you’re almost assured that they will never do business with you. So stop and consider why they did not pursue business with you. There are only two reasons:

Both of the above reasons can change with time. Let’s take a look at how to gain instant credibility.

Here’s an example. A 27-year-old stockbroker named Scott subscribed to our overnight author program. We printed our book Retirement Investing with his picture and biography. We made him an overnight author.

He gave a seminar. An elderly couple in their 80s came in to see Scott. Twenty minutes into the appointment, Scott sees that these people think he’s a youngster. He asks them, “Did I give you a copy of my book?” “You wrote a book?” asks the elderly gentleman. Scott hands him the book. He looks at the front. He turns it over and looks at Scott’s picture and biography on the back. “Ethel, he wrote a book!” says the old man to his wife. Within 20 minutes they were signing the papers to transfer their $1.1 million investment account from a major securities firm to Scott.

All aspects of superior financial advisor marketing must have the objective of gaining credibility FAST. One way to increase your trust and credibility in the prospect’s eyes is to become an expert. This can happen in a few minutes, as the above story indicates. So if you get interviewed in the newspaper (our Public Relations Kit explains how to make that happen) or have a book published (our Overnight Author Program is for you) or appear on a television show, in an instant, you become an expert.

ANYONE can implement such financial advisor marketing tools. To do them quickly, you hire others. Whats’ that, you don’t want to invest in your business? Save yourself and go get a government job now.

Early in my career, I sold securities in a bank. Some depositors came to the bank once or twice weekly and, every time, see me sitting at the same desk. They knew that I offered investment options that paid more than their CDs. But they did not approach. After a few months, they started coming to me to ask, “How can you help me?”

I did not do anything other than show amazing consistency. I was always there!

How do you replicate this if you do not work in a bank? With a newsletter. You send it every month, month after month, to those 28 people from the seminar that did not make an appointment with you and to the six who did not do business (and to every other prospect in your database). Month after month you stay in front of them, and eventually, you’re the most trusted financial adviser they know! Because you’re always there!

Any type of drip marketing works like a financial newsletter or monthly letter (you cannot do this quarterly, as it’s too infrequent) and holiday cards for every possible holiday. The goal is to stay in their face. I get at least one call each week from someone who attended some past seminar or responded to one of my ads or mail pieces months ago. Those calls are almost always sales. If you had 50 extra sales a year (one per week) from people calling you, would that increase your income?

This type of drip marketing works while you sleep. You can set up software to do it and then have some hourly person or outside firm do the mailing. Set up a system so that you can ignore it, and the system just keeps on working, making your phone ring.

Now you have two important components of financial advisor marketing that make life easier and increase your earnings:

Most salespeople talk too much.

The more you tell, the less you sell.

If you want to close a lot more sales, do nothing but ask questions for the first half of your client interview. The payoffs to asking questions are enormous. Questions increase your sales in five ways, to:

How would you like to make your prospects think what you want them to think? You can indeed direct your prospect’s thoughts with your questions. Before we proceed, would you make a mental picture of a large gray elephant for me? With this simple question, I can make you form a mental picture. And you can consistently direct your prospects’ mental activity in the same way. I know one super salesperson that asks prospects, “What are your plans when your health fails?” Immediately the client’s thoughts and mental pictures turn to scenes in a hospital bed or wheelchair. Questions are your most powerful tools for closing more sales.

Additionally, questions allow you to find out the facts (how much money they have, how much tax they pay, how are their current investments allocated, what insurance do they have) and allow you to protect yourself. You must have all of these facts before you can ever ethically and legally discuss any recommendations (“know your client” rule).

More importantly, questions allow you to determine emotional preferences: what do you like/not like, what’s comfortable/uncomfortable, what do you move toward/away from? Do you feel comfortable with the stocks you own, or nervous? If you became disabled tomorrow, what would you feel remorse about not having completed? These emotional questions are critical to understanding your client’s feelings. They keep you from making recommendations that will never fly with your prospect.

Junior financial advisers often think their job is to do the “best thing” for the client and to have lots of product knowledge. The best thing for a particular prospect might be tax-sheltered growth, and the advisor, therefore, recommends a variable annuity. But if the prospect is afraid of market fluctuations, then this recommendation is dead in the water before it is spoken! Therefore, the “best thing” is an appropriate recommendation that your prospect also feels comfortable with. And you can only know what’s comfortable by asking questions.

Questions communicate to the prospect that you are a professional and that you are thorough, that you get all the facts before starting a sales pitch. You position yourself as a true advisor, a knowledgeable expert, rather than salesperson. (Think about a visit to the doctor. Notice how he relentlessly asks questions and hesitates to make any diagnoses until he is 98% sure? If you did the same with your prospects, your closing ratio would soar.)

You can always tell the smartest guy in the room,

not by what they say, but by the questions they ask

Questions allow YOU to control the conversation. If the prospect starts firing questions at you, and you start answering them, who is in control of the conversation? You’ve lost control and the probability of a sale is very low. Picture an intersection full of traffic. Do you want to be the cop in the center directing the traffic or one of the drivers being told to make a left turn? Questions allow you to stay in control of the sales conversation.

As you see, ignoring the lost art of asking questions can cost you dearly. Where can you learn this skill? The best books I have seen are Neil Rackhams’s “Spin Selling” and “Spin Selling Field Book.”

Even when you do start to “tell” rather than ask questions, end each explanation in a question and give your statements real power, as in this example:

“This mutual fund has had a five-star ranking, the highest rating, for the last 15 years. And you do want the best, don’t you?”

By ending every explanation or paragraph in a question, you have the prospect “buy-in,” and you also test their temperature. If you ask the above question and they stare into space or start squirming, you know right away something is off, that you are misreading the prospect. You can then ask, “That fact seemed to make you uncomfortable. Did it?”

Employ questions for a powerful increase in your closing ratio. That would be great, wouldn’t it?

Tags

Financial Advisor Marketing | Financial Marketers | Financial Advisor Leads | Financial Planning Leads

This is actually some great advice thanks!